Fast, Flexible Access to Direct Lending Solutions

Fast, Flexible Access to Direct Lending Solutions

Fast, Flexible Access to Direct Lending Solutions

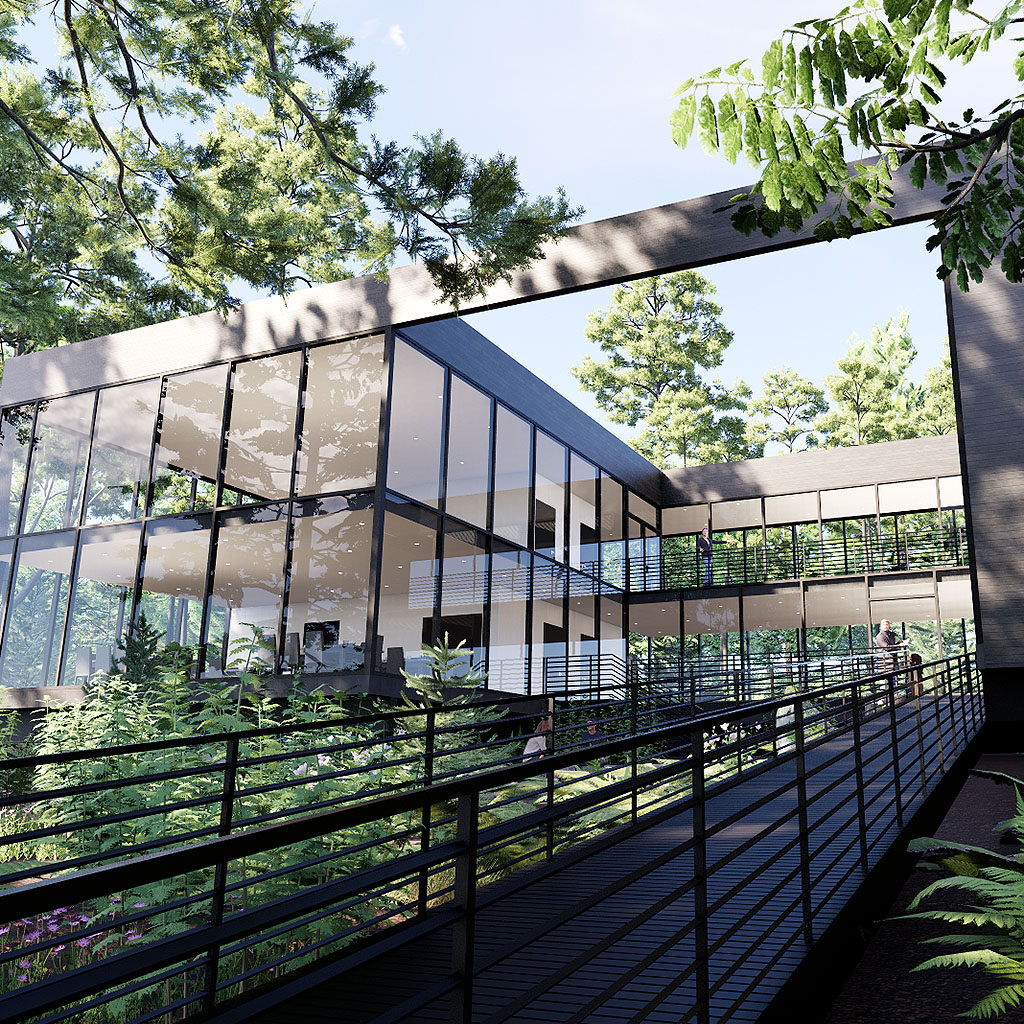

Innovative lending solutions for builders, developers, real estate investors, entrepreneurs, business/property owners, and others in California and the western United States.

Our extensive background in real estate development coupled with a can-do attitude allows us to offer fast, flexible, no-nonsense access to capital for horizontal and vertical improvements, property purchases, fix-and-flips, real-estate-backed investment opportunities, and more.

let's get started

Business Purpose Loans for Commercial Real Estate

Land

- Entitled

- Unentitled

- Single-Family Land

- Multi-Family Land

- Commercial Land

- Agricultural Use

CONSTRUCTION

- Horizontal and Vertical

- Single-Family Residences

- Multi-Family Residences

- Fix & Flip

- Tenant Improvements

- Rehab/Value-Add

- Repositioning

COMMERCIAL BRIDGE

- Office, Industrial, Retail

- Residential Rentals

- Commercial Loans

- 1031 Exchange

- NNN Loans

- Mixed Use

How We Work

FAST

Business and investment opportunities can’t wait, so why should you? We specialize in quick turn-around times and expedited approvals to connect you to the capital you need.

FLEXIBLE

As a private lender, Enact Partners provides financing solutions often not available through traditional banks. We structure loans to meet YOUR unique needs, not ours.

TRANSPARENT

We don’t like surprises and we know our clients don’t either. We keep you informed and engaged every step of the way from application to approval to closing . . . and beyond.

Portfolio

Featured Loans

Construction

Vertical Construction of a single-family residence (SFR)

$ 705,000

Boise, ID

Commercial Bridge

Acquisition of 75 acres with event space

$ 5,000,000

Humble, TX

Commercial Bridge

Retail Building with Two Restaurants

$ 1,500,000

Sacramento, CA

Success Stories

What clients are saying about their experiences with Enact Partners.

Enact Partners has been an amazing organization to work with. They listened to our needs and then offered their solutions. Their attention to detail made the entire process easy. Their communication skills are great, which made closing the loan smooth. We are so grateful for finding such a quality Business Lender. Michael, we sincerely do appreciate your working with us in such a friendly manner. We tried so many banks and found them to be disinterested in working on a loan that didn't fit in their BOX. We will be forever grateful for your trust in us. Thanks.

- Connie J.

I have worked with numerous lenders across the country and Enact Partners is by far the best. They do what they say they’re going to do and they are a pleasure to work with. Enact Partners got us funded on time with no hiccups or surprises and they will continue to be my first choice for financing. I recommend them highly.

- Jim S.

We truly enjoy working with Enact Partners. Mavis and (the team) are very responsive and informative. The loan and draw processes are quick and straight forward.

- Jason M.

This experience (with Enact Partners) was different from working with stuffy, hard-to-communicate-with banks. I wanted to take a moment and thank you for helping us with our loan. It was such a pleasure working with Enact Partners. Your assistance and thoroughness throughout the process was incredible. The positive can-do attitude that your whole team displayed was so refreshing. I was also impressed with your consistent responsiveness. Your quick response to my calls and text messages really made me feel special. This experience was different from working with stuffy, hard-to-communicate-with banks. I sure hope we have the opportunity to work together again.

- Linda M.

When dealing with Enact Partners, they are on your team. All negotiations and deal structuring are done in a win/win manner. Excellent partners!

- David W.

Enact’s communication and personal attention to every detail made all the difference in getting our deal done. We engaged Enact Partners in the fall of 2021 to help us in a very complex real estate transaction. Throughout the entire process, Enact was extremely responsive and easy to work with. I can’t thank Michael and his team enough for how professional they were in helping us close the deal and on time.

- David P.

We would definitely work with (Enact Partners) again and would highly recommend. Our experience with Michael and the Enact Partners team has been outstanding. They financed a large project for us, and we found them to be a great lender who could see value in our future plans. They were very nimble in their underwriting and facilitated a smooth, quick closing. The entire team has always been knowledgeable, professional, and easy to reach. We would definitely work with them again, and would highly recommend.

- Drew H.

Enact Partners has been a pleasure to work with on our loans. They are knowledgeable and have a very efficient loan and communication process resulting in a low stress and quick-closing transactions. Even more, they are really nice folks to do business with. I highly recommend Enact Partners and look forward to future business.

- Brian H.

In 2021, we had the pleasure of working with Enact Partners on a Finance deal for expansion. It was an exceptional experience filled with professionalism, honesty and flexibility. The entire team was passionate, genuine, and extremely supportive with Michael Schumacher leading the way. What sets (Enact Partners) apart is their unique combination of commitment, integrity, and a genuine passion for people to succeed. Their ability to connect and get the job done is second to none. We highly recommend Enact Partners.

- Daun F.

Finally, a company that works like I do: gather the facts and make a decision. Enact has been swift, professional, and continued great service after the sale was complete.

- Cindy B.

Everyone at Enact Partners has been a joy to work with. They are clear about the lending process and responsive to my many, and sometimes repetitive, questions. What I appreciate the most is that I truly feel they are shoulder-to-shoulder with me to make my business a success. Partnership isn't a contractual word at Enact, it is a way of being.

- Ann B.

Michael Schumacher and the entire team at Enact Partners are a pleasure to work with. From start to finish, the process was efficient and the turnaround times were extremely quick. We will continue to utilize the team on Enact in all of our future deals.

- Mike B.

Enact Partners came in to refinance a complex residential transaction for me in less than two weeks. Their responsiveness, attention to detail, solutions-oriented nature, and out-of-the-box thinking made them the perfect partner to close with on a tight timeline. I would not hesitate to work with (Enact Partners) again and cannot recommend their team highly enough.

- Emily L.

(Enact Partners) is easy to work with and have always performed on time or ahead of schedule. Enact Partners has funded multiple loans for our company over the years. The speed of funding is important to us and they have been excellent about acting quickly when it matters – in some cases, within just 4 days. We will continue to rely on the Enact Partners Team for timely and efficient funding. We have no hesitation in recommending them to anyone who may need financing options. These guys do great work and it’s refreshing to be able to count on them when we need them.

- Joe G. and Gary C.

I just wanted to reach out and say ‘thank you’ for making my build up here in Tacoma, WA a smooth and pleasant experience. The entire process was smooth and the software we all used to submit the draws and load photos was very helpful. I never felt that you guys didn't have my back the entire process. The building and landscaping turned out fantastic and I just signed my first tenant into the left side yesterday! Thanks again and I hope to work with you again in the future.

- Steve

The Enact Team is a pleasure to work with. As a Capital Advisory, Design and Entitlement Management company with a 30-year history of providing professional services to the real estate development and finance industries throughout the Western United States, we have had the privilege of working with the entire team at Enact Partners over the past five years and have found them not only to be consummate professionals in the private money lending space, but also extremely experienced in all facets of complicated real estate finance and lending transactions.

- John S.

Enact Partners is an outstanding lender to work with. All Enact team members are extremely knowledgeable and professional, which made the transaction move forward quickly and efficiently. It is important to note that Enact’s underwriting process was completed quickly and they closed shortly thereafter on a complicated land loan. Importantly, Enact processed draw requests and funded within a few days. We would wholeheartedly work with Enact Partners in the future.

- Shellie K.

You guys (Enact Partners) are great. You're very personable and absolutely the type of lender I need. I love how you visit the sites. It provides the best view of the project as a whole and, as you know, each project is unique and doesn't always fit into the same box.

- Paul S.

Questions

Frequently Asked Questions

Got questions? Start here with answers to frequently asked questions for borrowers. If you don’t find what you’re looking for here, feel free to contact us.

Like banks, Enact Partners lends funds for real estate investments. Unlike banks, we are not regulated by the Federal Reserve, so our process tends to be much easier and faster, with less red tape.

Our funds come from main street investors, not Wall Street. This means our rates are not affected by the Fed’s interest rate hikes, and we do not shut down due to macroeconomic trends, like banks and Wall Street-backed institutional private lenders sometimes do. For example, during the height of the COVID pandemic, when many banks stopped lending (in some cases right in the middle of construction projects), Enact Partners continued lending.

We do short-term loans for land, horizontal construction, vertical construction, acquisition, bridge, and business purposes. This typically includes single-family land, single-family residences, multi-family land, multi-family residences, commercial land, office, retail, industrial, hospitality, short-term vacation rentals, and agricultural land.

We do business primarily in the western United States. This includes the following states: California, Oregon, Washington, Wyoming, Idaho, Montana, Nevada, Arizona, Utah, Colorado, New Mexico, and Texas.